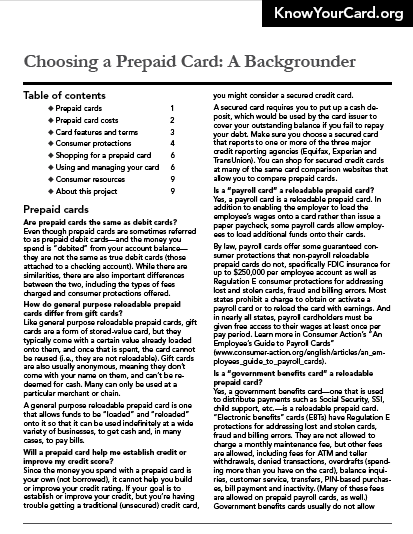

Choosing a Prepaid Card: A Backgrounder

The "Choosing a Prepaid Card" training manual provides the answers to many of the questions that a consumer shopping for a reloadable prepaid card might have, from "Where can I find a list of the card's fees?" to "Whom do I contact if I have a problem with my card?"

Publication Series

- This publication is part of the Choosing a Prepaid Card training module.

Download File

PDF files may contain outdated links.

Choosing a Prepaid Card: A Backgrounder

File Name: prepaid_QA_2015.pdf

File Size: 0.08MB

Languages Available

Table of Contents

Prepaid cards

Are prepaid cards the same as debit cards?

Even though prepaid cards are sometimes referred to as prepaid debit cards—and the money you spend is “debited” from your account balance—they are not the same as true debit cards (those attached to a checking account). While there are similarities, there are also important differences between the two, including the types of fees charged and consumer protections offered.

How do general purpose reloadable prepaid cards differ from gift cards?

Like general purpose reloadable prepaid cards, gift cards are a form of stored-value card, but they typically come with a certain value already loaded onto them, and once that is spent, the card cannot be reused (i.e., they are not reloadable). Gift cards are also usually anonymous, meaning they don’t come with your name on them, and can’t be redeemed for cash. Many can only be used at a particular merchant or chain.

A general purpose reloadable prepaid card is one that allows funds to be “loaded” and “reloaded” onto it so that it can be used indefinitely at a wide variety of businesses, to get cash and, in many cases, to pay bills.

Will a prepaid card help me establish credit or improve my credit score?

Since the money you spend with a prepaid card is your own (not borrowed), it cannot help you build or improve your credit rating. If your goal is to establish or improve your credit, but you’re having trouble getting a traditional (unsecured) credit card, you might consider a secured credit card.

A secured card requires you to put up a cash deposit, which would be used by the card issuer to cover your outstanding balance if you fail to repay your debt. Make sure you choose a secured card that reports to one or more of the three major credit reporting agencies (Equifax, Experian and TransUnion). You can shop for secured credit cards at many of the same card comparison websites that allow you to compare prepaid cards.

Is a “payroll card” a reloadable prepaid card?

Yes, a payroll card is a reloadable prepaid card. In addition to enabling the employer to load the employee’s wages onto a card rather than issue a paper paycheck, some payroll cards allow employees to load additional funds onto their cards.

By law, payroll cards offer some guaranteed consumer protections that non-payroll reloadable prepaid cards do not, specifically FDIC insurance for up to $250,000 per employee account as well as Regulation E consumer protections for addressing lost and stolen cards, fraud and billing errors. Most states prohibit a charge to obtain or activate a payroll card or to reload the card with earnings. And in nearly all states, payroll cardholders must be given free access to their wages at least once per pay period. Learn more in Consumer Action’s “An Employee’s Guide to Payroll Cards.”

Is a “government benefits card” a reloadable prepaid card?

Yes, a government benefits card—one that is used to distribute payments such as Social Security, SSI, child support, etc.— is a reloadable prepaid card. “Electronic benefits” cards (EBTs) have Regulation E protections for addressing lost and stolen cards, fraud and billing errors. They are not allowed to charge a monthly maintenance fee, but other fees are allowed, including fees for ATM and teller withdrawals, denied transactions, overdrafts (spending more than you have on the card), balance inquiries, customer service, transfers, PIN-based purchases, bill payment and inactivity. (Many of these fees are allowed on prepaid payroll cards, as well.) Government benefits cards usually do not allow cardholders to load additional funds onto their cards.

Is it better to have a checking account or a prepaid card?

That depends on your immediate and long-term goals and your past banking history.

A traditional bank account (checking or savings) offers several benefits for achieving financial security, and is probably the best choice for someone looking to achieve long-term financial goals. A traditional account can also lead to opportunities to obtain credit at reasonable rates and to build a good credit history, which can ultimately help consumers save money in the form of lower interest rates on auto financing, a mortgage or other types of loans and credit.

If you want to avoid any possibility of “bouncing” a check, you can’t get an account because of past banking problems (unpaid overdrafts or fees) or you simply don’t want a traditional checking account, then a prepaid card might be the right choice for you. Prepaid cards also serve as a tool for anyone who wants to give someone else access to limited funds—allowance for a teen or spending money for a caregiver, for example.

While many consumers opt to have a checking account or a prepaid card, you don’t have to choose between the two—you can have both if that is the best way to meet your needs. The important thing is to choose the best of each.

Prepaid card costs

How much does a prepaid card cost?

The monthly cost of a prepaid card will depend on the card’s fees (type and amount) and how you use the card. Some cards will cost you much less than other ones. Once you’ve narrowed down your card options, calculate your monthly cost for each based on how you expect to use the card. If there’s a one-time purchase or activation fee, divide it by 12 and add it to the monthly usage cost to get the total monthly cost for the first year. (A purchase or activation fee will not factor into the monthly cost in subsequent years, should you keep the card.)

How can I compare the cost of cards when they charge different types and amounts of fees?

Try to estimate and calculate the total monthly cost of each card option based on how you expect to use it. For example:

CARD 1

Monthly fee = $5.00PIN transaction fee = $0.00 (estimating eight per month @$0.00/each)

Signature transaction fee = $0.00 (estimating four per month @$0.00/each)

ATM withdrawal (out-of-network) = $4.00 (estimating two per month @$2/each)

Total monthly cost if used as estimated = $9.00

CARD 2

Monthly fee = $0.00PIN transaction fee = $4.00 (estimating eight per month @$0.50/each)

Signature transaction fee = $1.00 (estimating four per month @$0.25/each)

ATM withdrawal (out-of-network) = $6.00 (estimating two per month @$3/each)

Total monthly cost if used as estimated (including direct deposit) = $11.00

Be aware that the usefulness of this cost analysis method depends on the accuracy of your estimates about how you’ll use the card in a given month, and your consistency in using the card in that way.

Which is more expensive, a prepaid card or a checking account?

It depends on the fees charged on each and how you use the account. For example, a checking account with no monthly fee will almost surely be the less expensive option if you don’t overdraw your account and you use the bank’s own (in-network) ATMs. If, on the other hand, the checking account assesses a monthly fee and you typically accrue overdraft and/or ATM fees, then a prepaid card could be a much less expensive option. When it comes to paying bills, online bill-pay with a checking account enables you to pay just about anybody via the bank’s website or app, and the service often is free. A prepaid card may allow you to pay bills, but perhaps not everyone (meaning that you might have to buy money orders and postage), and there may be a fee for the service.

The fees on a consumer-friendly checking account or prepaid card will almost always be less expensive than using check cashing services and paying your bills with cashier’s checks or other costly bill payment services.

Where can I find a list of a card’s fees?

The best place to look for the fee schedule is on the card packaging and/or at the card website. However, there is currently no industry standard or law governing prepaid card fee disclosures.

Still, some prepaid card issuers voluntarily are more transparent about fees. Choose one that provides fee information clearly and completely. If it takes pages to explain all the fees and when they could be assessed, you might want to consider a card that is simpler to understand and manage.

The Consumer Financial Protection Bureau (CFPB) is proposing new consumer protection rules for prepaid cards, including disclosures that would provide consumers with standard, easy-to-understand information about the prepaid account. The CFPB’s proposal likely will require card issuers to concisely and clearly highlight key prepaid account information, including common costs like the monthly fee, fee per purchase, ATM withdrawal cost and fee to reload cash onto the account. In addition, under the CFPB’s proposal, consumers would have to receive or have access to a full set of the account’s fees and related information before acquiring the account.

The rules are expected to be established in late 2015, though they most likely would not take effect immediately.

Can I avoid the upfront cost of buying a prepaid card?

Many, if not most, cards charge a purchase fee and/or an activation fee. You might be able to avoid a purchase fee by buying the card online rather than in a store.

What can I do to avoid prepaid card fees?

Before you can avoid prepaid card fees, you have to know what they are—check the fee schedule on the card’s packaging and/or website. Depending on the card, some of the ways you might be able to avoid fees include:

- Loading a minimum amount onto your card each month

- Having your paycheck or other income direct deposited into the card account

- Maintaining a minimum account balance

- Loading funds into the account by whichever method is free (if there is one)

- Using network ATMs (check the card website or ask a customer service representative for the locations of free ATMs)

- Getting cash back when making purchases at a grocery store (and some other retailers) so that you can avoid using an ATM altogether

- Choosing the transaction type—debit (PIN) or credit (signature)—that is free (if there is a fee for one and not the other)

- Checking your account balance using a free option if one exists, such as registering for an online account with the issuer

- Avoiding cards that allow you to spend more money than is in your account (and be charged an overdraft fee)

- Opting out of paper statements if they carry a charge and viewing your statement online instead

Card features and terms

My card allowed me to spend more than was in my account. How could that happen?

Some cards intentionally allow overdrafts—and charge a hefty fee each time you spend more than is in your account. If your card is one that doesn’t allow overdrafts, any transaction that would push your account balance into the red will be declined. However, there are occasions when a transaction is processed without first being submitted to the card issuer for authorization. While these types of transactions are limited, they do occur, and could cause you to overdraw your account. In such a case, your card issuer should not charge you an overdraft fee even though it may legally be allowed to. If you are charged, call customer service and ask that the fee be reversed.

Do prepaid cards offer rewards or benefits like credit cards do?

Some prepaid cards now offer rewards programs (points, cash back, etc.) similar to those offered by credit cards. But don’t be tempted to choose a card that has higher fees just to get the rewards. In that case, you’d be better off choosing a low-cost card that meets your needs but offers no rewards.

Some prepaid cards also offer benefits such as roadside assistance, traveler’s assistance and purchase protection. (Purchase protection typically extends the standard manufacturer’s warranty, reimburses you for lost, stolen or broken items purchased with the card, and/or credits you the difference between what you paid for an item and a lower advertised price within a certain time frame.)

Not all prepaid cards offer rewards, purchase protection or other benefits. Among those that do, terms vary, and there are usually exclusions, so check your card agreement for details. Research the availability of and restrictions on these benefits beforehand if they are important to you and will influence your card selection.

Should I choose a prepaid card with a savings feature?

If you have low savings and are unable to open a savings account at a bank or credit union, a prepaid card with a savings feature might be a good idea. Not all prepaid cards offer such a feature, so you’d have to shop around. However, those that do allow you to set aside money sometimes put a cap on the amount you can accumulate (which defeats the purpose of a savings account) or on the portion of your balance that qualifies for the eye-catching interest rates, or they require you to maintain a minimum balance or automatic monthly deposit in order to open an account or earn interest. And since you can only make deposits and withdrawals via the prepaid card, you could incur fees for every savings-related transaction—something to watch out for.

Also, unless you have a written guarantee that any account funds that are lost or stolen would be replaced, you could lose all your savings. Even if your prepaid card has a policy of reimbursing lost funds, it is voluntary and could change at any time. (Rules requiring reimbursement are being considered, but have not been approved or implemented yet.)

A better option for savings, if you can manage it, is to open a traditional savings account at a bank or credit union. With such an account you would get the benefit of developing a relationship with a financial institution that might be able to help you open other types of accounts or take out loans and build credit in the future.

I didn’t sign a card agreement—does that mean I haven’t agreed to the card terms and conditions?

No. By requesting the card, signing the back of the card and/or using the card you have effectively accepted the card terms and conditions. That’s why it is very important to read and understand the terms and conditions before you make a card choice.

Consumer protections

Do prepaid cards have to follow the same rules as credit and debit cards?

Though many card issuers voluntarily provide some good consumer protections on their general purpose reloadable prepaid cards, currently only limited federal consumer protections exist for most prepaid accounts. However, the Consumer Financial Protection Bureau (CFPB) has proposed strong new rules that would mandate federal consumer protections for all prepaid card users. The proposal would require prepaid card companies to limit consumers’ losses when funds are stolen or cards are lost, investigate and resolve errors, provide easy and free access to account information, and adhere to credit card protections if a credit product (i.e., overdraft coverage) is offered in connection with a prepaid account. The CFPB is also proposing new prepaid disclosures that would give consumers clear information upfront about the costs and risks of prepaid products. Get details about the proposed rules at the CFPB website.

Payroll cards and federal, state and local government benefits cards (used to disburse such things as unemployment insurance, child support and pension payments) generally have stronger protections than general purpose prepaid cards.

What laws or regulations govern prepaid cards?

Prepaid cards are not as heavily regulated as credit and debit cards. While many prepaid card issuers do extend certain protections such as “zero liability” and agree to handle disputes and fraud claims in a consumer-friendly way, these promises are voluntary and, as such, can be rescinded at any time.

In late 2014, the Consumer Financial Protection Bureau (CFPB) proposed strong new federal rules for prepaid cards. (See previous question.) The rules are expected to be established in late 2015, though they most likely would not take effect immediately. Until that happens, be aware of the limitations and the variation in policies from card issuer to card issuer.

What is “zero liability” protection?

“Zero liability” is a voluntary policy of many debit, credit and prepaid card issuers that guarantees you will not be held responsible for any unauthorized transactions should your card be lost or stolen. Typically, this policy requires that the card be registered (not anonymous) and that you report a missing card and/or unauthorized transactions as soon as you become aware of the issue.

Be aware that there may be exclusions and limitations on zero liability protection. For example, the policy may not cover ATM or certain other types of transactions. And such voluntary policies are subject to change at any time.

Can I dispute a transaction made with my general purpose reloadable prepaid card the way I can with a credit card?

You can dispute a transaction that you believe is fraudulent or erroneous. It is likely that the prepaid card issuer will investigate. If it confirms that the transaction was an error or a case of fraud, it would likely remove it and reimburse your money. However, there is currently no legal requirement for a dispute resolution process on non-payroll/non-government-issued prepaid cards.

It’s important that you frequently check your transactions online so that you can catch any unauthorized activity as quickly as possible. Contact your card issuer’s customer service department as soon as you notice an error on your statement.

What if my card is lost or stolen—what happens to the money on the card?

Contact the card issuer immediately if you notice your general purpose prepaid card is missing. (Copy the toll-free number from the back of the card in case you lose the card. If you didn’t keep a copy of the number, look it up on the company website.) The issuer will invalidate the card to protect the remaining funds. Check your online statement for any transactions that you did not authorize. If you find any, report them immediately.

Some prepaid card companies, but not all, will voluntarily replace money stolen from your card. Such policies are subject to change at any time.

You can get a replacement card, but if you want it immediately the card issuer might charge you an “expedited delivery fee.” If you don’t need rush delivery, let the issuer know.

Are the funds on my card FDIC-insured the way my bank account balance is?

FDIC insurance covers you for up to $250,000 if your bank goes under. (National Credit Union Share Insurance Fund (NCUSIF) provides the same protection for credit union accountholders.) Whether or not you have FDIC coverage on the funds in your prepaid card account depends on how the issuer structures its cardholder accounts and whether the card issuer deposits customers’ money into FDIC accounts. The best way to get an accurate answer to this question is to ask the card issuer directly.

Do any consumer protections apply to my payroll card that don’t apply to general purpose reloadable prepaid cards?

Payroll cards are subject to Reg. E, which, among other things, requires them to disclose any fees associated with the card, provide an error resolution process that protects cardholders from defective or undelivered goods, limit liability for unauthorized transactions to the same amounts as debit cards ($50 if you notify the bank within two business days after learning of the loss or theft of your card) and provide 21 days’ notice before making changes to the card terms. General purpose reloadable cards are not required to meet these requirements. They also are not required to be FDIC-insured, while payroll cards are.

How do I take advantage of the voluntary protections my card issuer offers?

To understand exactly what your card’s policies are, review the information that came with the card or that appears on the card website. Be aware that to benefit from protections offered by your card issuer, you might have to:

Follow certain procedures (such as notifying the issuer of unauthorized activity within a specified number of days), or

Meet certain criteria (such as having the loss occur as the result of a signature transaction rather than a PIN transaction).

Knowing exactly what the card issuer’s policies are allows you to make informed choices, such as purchasing by PIN or signature or filing a dispute within a certain time.

Do I have to provide personal information to buy or use a reloadable prepaid card?

Yes. Typically a reloadable prepaid card issuer will require your name, address, phone number, birthdate and a government-issued identification number (Social Security number (SSN), individual tax identification number (ITIN), passport number, driver’s license number or matrícula consular number). In addition to using this information to verify your identity and mail you your personalized card, “registration” is required in order for you to be reimbursed for any lost or stolen funds (if the issuer offers such reimbursement) or to receive a replacement card. You’ll also share whatever information is required for reloading the card—for example, your bank account number if you will be transferring money from there.

What government agency do I complain to about a prepaid card problem?

If you have a complaint about a prepaid or other type of payment card, file it with the Consumer Financial Protection Bureau (CFPB) or 855-411-2372. The agency will help you resolve your complaint.

In summer 2015, the CFPB started including complaint “narratives” on its website—the details of the complaint in the consumer’s own words. This information could prove helpful as you assess card issuers and narrow your card options. To get an idea of the complaints against a card issuer or product, and to see if and how they were resolved, visit CFPB complaint database website and then click on “Read consumer narratives.” Use the filter or search function to narrow the results.

Shopping for a prepaid card

Should I get a prepaid card?

Every payment option has advantages and disadvantages. To make sure you choose the best one for your needs, compare prepaid cards, credit cards (secured cards are an option if you don’t have the credit history to qualify for a traditional unsecured card) and checking accounts (which usually feature a debit card).

How do I get a general purpose reloadable prepaid card?

You can get a general purpose reloadable prepaid card from many retailers, banks or online. Ideally, you should research your options online before deciding on a card rather than choosing one off the rack at a retailer or responding to a marketing pitch. There are a number of card comparison websites that make the process quicker and easier. Consumer Reports and other publishers release prepaid card surveys periodically. You can also shop for cards at the Visa, MasterCard, Discover and American Express websites.

For any card you’re considering, visit the card’s website and read the disclosures carefully. Make sure the card offers all the features and functionality you want. (For example, some bank-issued prepaid cards may not offer online bill-pay. If that function is important to you, confirm that it is available in any card you consider.)

After identifying which card has the features you want at the lowest cost, submit your application. You can expect to receive your card in about one to two weeks. Follow the activation and registration instructions, and sign the back of the card.

What information do I have to provide when I request a prepaid card?

Typically, a card issuer will ask for identifying and contact information such as your name, address, birthdate and Social Security number. If you plan to load your new card from a bank account, credit card or other source, you’ll need to provide that information, too.

The card I’m choosing gives me the choice between a “pay-as-you-go” plan or a monthly fee plan—which is better?

That depends on how you use the card and how much the fees are. Someone who uses a prepaid card infrequently would probably save money by choosing the pay-as-you-go plan. These plans typically assess a low or no monthly fee. And although the per transaction fees are higher, they might still total less than the monthly fee plan if you only use the card a few times a month. A monthly fee plan is usually a better option for heavy users because the per-transaction fees on these plans are usually lower.

Some cards offer more than one monthly fee plan, so you have to make accurate predictions about how you’ll use the card in order to make the best choice.

Using and managing your card

How do I add money to my prepaid card account?

Depending on the card, you may be able to load and reload via direct deposit of your income (paycheck, benefits payments, etc.); with cash at a network location (such as a Western Union agent, Walmart store or bank branch); by bank account (savings or checking/debit card) transfer; or from a PayPal account. Not all cards allow all reload methods. Make sure the card you choose allows you to reload in the ways you want.

Reload fees—if any—vary. It’s easy to find cards that allow direct deposit with no fee. Many even reduce or waive the monthly maintenance fee if you set up direct deposit.

How much money can I spend or load onto a prepaid card?

Card issuers set their own daily or monthly limits. Typically, there is no limit on the purchases you can make as long as there are sufficient funds in the account to cover them. There can be limits on the frequency and/or dollar amount of reloads or cash withdrawals within a given time period. To learn more about the limits on a card you already have or are considering, check the card policies or contact the card issuer.

What’s the difference between a PIN transaction and a signature transaction?

A PIN transaction requires you to use a keypad to enter your personal identification number, while a signature transaction requires you to sign a receipt. The cashier may ask you if you want to make a debit (PIN) or credit (signature) transaction at the time of checkout. The outcome is the same—the money is deducted from your prepaid card balance—but there may be advantages to choosing one over the other.

For example, some card issuers charge a fee (or a higher fee) only for one type of transaction or the other. Choosing the free or less expensive option when asked “debit or credit” would save you money. And some card issuers offer stronger consumer protections on signature transactions or issue rewards points or other benefits, such as purchase protection, only when you sign for a purchase.

To avoid fees and/or make sure you receive the protections and benefits you want from the card, make sure you understand your card issuer’s policies before making the “credit or debit” decision for the first time. (If you want to conduct a credit/signature transaction but the merchant’s terminal automatically prompts you for your PIN, let the cashier know that you want to sign for your purchase.)

You will most likely receive the greater security protections normally extended to signature transactions even when you aren’t able or required to sign for the purchase (for online, phone and mail orders and small-dollar transactions under $25 or $50), but check with your card issuer.

How can I make a purchase if there’s not enough money on my prepaid card?

Assuming that your card does not allow overdrafts (a very expensive feature that you should avoid), your transaction will be declined if your attempted purchase is for more than the balance on your card. Some cards charge a “declined transaction fee”—a good reason to know your balance and avoid trying to make purchases that exceed it.

Some merchants will allow you to conduct a “split tender” transaction, where you use the available balance on your prepaid card and pay the remainder with another form of payment (cash, check or other payment card). Generally, this requires you to tell the merchant before the transaction begins how much you want to pay using your prepaid card and how much with the other form of payment.

How do I keep track of my card balance?

If you have regular access to the Internet and a computer, smartphone or tablet, choose a card that allows you to log in to your account regularly at the cardholder website or via a mobile app to view transactions and the card balance. Sign up for text and/or email account balance alerts.

You can also check your card balance at an ATM or by calling customer service, but some card issuers and ATM owners charge a fee for doing so. Investigate this before choosing a card.

Will I receive a monthly transaction statement?

It’s unlikely you’ll receive a printed transaction statement in the mail, and if you do, there may be a fee for it. Check with the card issuer. If there is a fee and you do not want the paper statements, ask if you can “opt out.”

If your issuer offers free emailed statements, sign up for them if they are not automatic. But don’t wait until your monthly statement to check your account activity and balance. Check it online or via mobile app frequently. Choose a card that allows you to check as you want at no charge (most, but not all, do).

Proposed rules for prepaid cards would make it a requirement for card issuers to either provide periodic statements or make account information free and easily accessible online. (See “Consumer protections” section above for more information about proposed federal rules for prepaid cards.)

I bought $20 worth of gas but the station blocked $100 of my account balance—can they do that?

When you pay at the pump for gas and the final purchase amount is not known in advance, the card issuer typically puts an “authorization hold” on funds to cover the estimated cost of the transaction to make sure that you don’t overspend and the merchant gets paid. The hold tends to range from $50 to $125, and typically drops off within 24 hours, but could stay on for up to 72 hours. (The gas station determines the amount of the hold, while the card issuer determines the length of the hold.)

You can avoid a hold on account funds for more than the amount of your purchase by handing your card to the cashier before pumping, and then retrieving the card and a receipt afterward.

Other businesses that place holds include restaurants (to cover the estimated tip) and hotels (to cover incidental charges to your room—phone and room service, for example—between the time you check in and check out). The hold for a hotel room can be very high and not drop off until after you check out.

Plan for holds so that your money isn’t tied up when you need it. (Authorization holds are common on credit and debit cards as well.)

Can I make reservations with car rental companies, hotels or airlines using my prepaid card?

While you may be able to pay the final bill with your prepaid card, you might not be able to use your card to make your reservation with an airline, hotel or car rental company.

How can I get cash with my prepaid card?

You may be able to get cash back at places like grocery stores by hitting the “Debit” button after swiping your card and then selecting the amount of cash you want.

You can also use your prepaid card to get cash from an ATM. Your card issuer may charge a fee for this. And if the ATM you use is not owned by your card issuer or part of its network, you will be charged another fee by the machine owner. If you plan to use your card to get cash from ATMs, choose a card that offers at least one or two free ATM withdrawals per month and has conveniently located network ATMs where you can avoid the second fee.

There may be limits on the amount of cash you can withdraw from your card account—or deposit into it—per day, week or month, depending on the card issuer’s policies.

Does the expiration date on my card mean that I have to use all the money on my card by then or lose it?

The expiration date on your prepaid card applies only to the card itself, not to the funds in your account. (A “valid thru” date on your card enables you to use it for online and phone “credit card” purchases, which require that information.) The card issuer should automatically send you a replacement card before the current one becomes invalid. If it doesn’t (perhaps because the account has a zero balance and/or you haven’t used or reloaded the card in a long time), call the issuer to request a new card. If you close the account, you will receive the balance of your funds by check. There may be an account closure fee. Confirm with the card issuer that you do not forfeit any remaining balance if you close the account.

Will I be notified when the terms of my prepaid card agreement change?

Prepaid cards are not subject to the same notification requirements as credit cards. That means that issuers of general purpose reloadable prepaid cards can change terms and conditions at any time with or without notice. Still, many card issuers notify cardholders of changes, so be sure to read all communications (print, email, text, etc.) you receive about your card. You can also check the card website for any changes to the terms.

Consumer resources

Consumer Financial Protection Bureau (CFPB) / 855-411-CFPB (2372)

Takes complaints about consumer financial services, guides consumers to the appropriate regulatory agencies and offers money management tools and information.

Federal Trade Commission (FTC) / 877-382-4357

Works for consumers to prevent fraudulent, deceptive and unfair business practices and to provide information to help spot, stop and avoid them.

Consumer Action / 415-777-9635 / Hotline Complaint Form

Offers free information and advice on choosing and using prepaid cards. Hotline counselors speak English, Spanish and Chinese. Connect with us on Facebook and on Twitter.

KnowYourCard.org

A project of Consumer Action and Visa, this online payment card rule book explains everything consumers need to know about using credit, debit, prepaid and gift cards safely and wisely.

Published / Reviewed Date

Published: October 14, 2015

Download File

Choosing a Prepaid Card: A Backgrounder

File Name: prepaid_QA_2015.pdf

File Size: 0.08MB

Sponsors

VISA Inc.

Notes

Consumer Action created this publication in partnership with Visa Inc. (http://usa.visa.com/personal/personal-cards/prepaid-cards/index.jsp)

Filed Under

Banking ♦ Money Management ♦ Prepaid Cards ♦

Copyright

© 2015 –2024 Consumer Action. Rights Reserved.