Released: September 01, 2004

Fall 2004

Table of Contents

- Despite poor economy, CA raises $30,000 at June party

- Federal law targets ID theft

- Settlement means millions for consumer advocacy

- Call for full disclosure of 'bounce loan' costs

- Watch out for realistic but bogus cashiers' checks

- MoneyWi$e news

Despite poor economy, CA raises $30,000 at June party

Consumer Action (CA) raised about $30,000 from its June 9 annual anniversary party at the Marines Memorial Club in San Francisco. Donors in CA's "Inner Circle" this year included: Paul Aarons, AT&T, Microsoft, PG&E, SBC, UPS and S. Chandler Visher. (See a list of all party sponsors.)

CA Executive Director Ken McEldowney noted that financial support of the annual event has helped CA's multilingual web site (www.consumer-action.org) evolve into a top Internet address for consumers. "With the continued support of our friends, we can help many people, especially the most vulnerable low-income and unsophisticated consumers, protect themselves in the marketplace," said McEldowney.

|

He said that in the past year CA has added many new educational publications to its web site and made substantial progress toward its online National Consumer Services Guide. "The money we raise from our party also helps to support our free multilingual hotline and our newsletter, Consumer Action News, and enhances our advocacy work by allowing our staff the time to provide insight to the media, policy makers and businesses." |

|

Each year at its party, CA presents "Consumer Excellence Awards" to community-based organizations, consumer advocates and the media. This year's awardees were:

- Noticias Univision 14, a San Francisco Bay Area Spanish language news program.

- Barbara Roper, director of investor protection, Consumer Federation of America (CFA).

- The Family Learning Center of the Community Resource Project in Sacramento, CA.

Noticias Univision 14

Sol Carbonell, CA consumer advice counselor and a frequent spokesperson for CA with the Spanish-language media, presented the award to Sandra Thomas, news director of Noticias Univision 14. A Spanish-language news program of Univision KDTV 14, Noticias Univision 14 airs daily at 6 p.m. and 11 p.m. in the San Francisco Bay Area.

Carbonell thanked the program's staff members, including Thomas, Executive Producer Mahelda Rodriguez, Assignment Editor Jose Luis Tello, Anchors María Leticia Gómez and Tony López and Reporter Beatriz Ferrari, for helping to educate Spanish-speaking consumers on a wide range of topics, including work at home scams, the used car market, California's Spanish contract law, tenants' rights, cell phones and holiday shopping.

Noting that Univision KDTV 14 is celebrating its 29th year, Carbonell explained that the popular station serves more than 1.4 million Hispanic viewers in 11 Northern California counties with round-the-clock broadcasts. The station has been honored for its newscasts, community outreach and Bay Area relief work. Its community affairs program, "Encuentro en la Bahia," airs on Saturdays at 10:30 a.m.

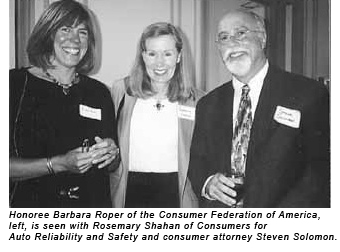

Roper honored

Barbara Roper is a leading national consumer spokesperson on investor protection issues who joined CFA in 1986. She has led groundbreaking advocacy efforts concerning abuses in the financial planning industry, state oversight of investment advisers, financial education for low income seniors, audit reform and the need for stronger mutual fund oversight.

After McEldowney presented her award and lauded her "tireless advocacy" to ensure fair treatment of investors, Roper joked that she is not altogether tireless and is growing weary of the manner in which individual investors receive unequal treatment.

Roper, who lives and works in Colorado for the DC-based CFA, has testified before Congress and supported federal and state legislative and regulatory initiatives on a range of investor protection issues. A graduate of Princeton University, she began her career as a newspaper reporter in Colorado Springs, where she later worked in the public information office of Colorado College.

Roper has served on the board of the Security and Exchange Commission's Consumer Affairs Advisory Committee and received the National Association of Personal Financial Advisors' Distinguished Service Award (1991) and a Distinguished Service Award from the North American Securities Administrators Association (1992).

Family Resource Center

Guadalupe Aguilar, a CA community consumer advocate, presented an award to The Community Resource Project (CRP) of Sacramento, for its innovative multilingual financial education programs incorporating Consumer Action MoneyWi$e materials.

The organization's Family Resource Center, headed by Lisa Yep Salinas, who accepted the award, seeks to improve life and educational opportunities for people in need through initiatives in the areas of housing, health and education.

"The Family Learning Center serves family members of all ages, from birth through the senior years, in order to help families become healthier and vibrant in every phase of the life cycle," said Salinas. The CRP was founded in 1972 to serve the needs of ex-felons by providing educational, vocational and job placement assistance for those who are ready for work. It provides supportive counseling to families to ease the transition of the ex-offender back into the mainstream of society.

Salinas explained that today the project has widened its scope to four counties and serves more than 47,000 low-income people each year. Salinas, who speaks Spanish and English, works alongside colleagues who communicate with clients in nine languages.

The Family Learning Center has been an effective partner in the MoneyWi$e financial literacy project since it was launched by Consumer Action and Capital One four years ago.

The Center also conducts consumer education outreach on topics such as telecommunications rights, MediCal for children and families, health services for uninsured children and safe car seats.

Happenings at CA

In recent months, Salinas also was named to Consumer Action's board of directors.

Dr. Irene Leech, a professor of consumer education at Virginia Polytechnic Institute and a leader of the Citizens Consumer Council, also joined the board.

Longtime board members Kay Pachtner (CA's founder) and Helen Nelson became board members emeritus this year.

At CA's San Francisco office, Joseph Ridout joined the CA staff as consumer services manager in charge of the consumer complaint hotline, and Tracy Boggs was hired by CA's Healthy Children Organizing Project as program associate.

At CA's Los Angeles office, Kathleen McGregor joined the staff, also as program associate.

| Consumer Action's 2004 supporters |

|---|

|

| From left, guests at CA's annual fundraiser include Jerry Flynn of SBC, Tim Leong of Pacific Gas and Electric, Charlene Zettel, Director of the California Department of Consumer Affairs and Jim Conran of Consumers First, who held the same office as Zettel in the early 1990s. |

| Corporate friends | Inner circle donors | Corporate benefactors |

|---|---|---|

|

Chavez & Gertler Comcast Jim Conran, Consumers First, LLC Direct Marketing Association Experian Inc. The Gas Company Hulett Harper Stewart LLP Arthur C. Levy Schrag & Baum Sam Simon, Issue Dynamics Southern California Edison Verizon |

Paul Arons AT&T Microsoft PG&E SBC UPS Chandler Visher |

American Express Company Capital One Edison Electric Institute PacifiCare Providian Sprint The Sturdevant Law Firm Visa USA |

Individual and community donors

| Benefactors | Friends |

|---|---|

|

James S. Beck Marsha Cohen Eugene Coleman Rich Sayers, 1010PhoneRates.com Law Offices of Steven Solomon Sponsors Alan Bauer Betsy Imholtz, Consumers Union Robert C. Friese Linda Golodner Sue Hestor Tom Jenkins and Dan Mulligan, Jenkins & Mulligan John Jensen, Grubb & Ellis Julia Ling, Chinese Newcomers Service Center |

Candace Acevedo Chris Bjorklund Paul Bland, Trial Lawyers for Public Justice Eric and Anna Alvarez Boyd California Service Station & Automotive Repair Association Cuneo Waldman & Gilbert LLP Ellis & Jennifer Cross Gans Molly Hopp Kinman & Curry Dr. Irene Leech Martin Mattes, Nossaman, Guthner, Knox & Elliott, LLP Audrey Moy Laurel Pallock Rosemary Shahan, CARS Jonas Waxman |

Federal law targets ID theft

In late 2003, the federal Fair Credit Reporting Act was amended to protect consumers against the fast-growing crime of identity theft. The Fair and Accurate Credit Transaction Act (FACTA) added new privacy rights, provisions to ensure accuracy and limits on information sharing. FACTA also gives consumers the right to get free copies of their credit reports each year

Although the changes for consumers are positive, consumer advocates criticize the new law for preempting tougher state laws.

Some FACTA provisions are in place now, while others won't be effective until December or until federal agencies, including the Federal Trade Commission (FTC), adopt final regulations. (Unless otherwise stated, provisions mentioned in this article are effective as of Dec 1.)

Beth Givens, director of the Privacy Rights Clearinghouse, a San Diego-based non-profit organization whose mission includes protecting consumers from identity theft and other privacy abuses, said, "Consumers win some and lose some with FACTA. The provisions require the credit industry to do a better job in checking credit applications for signs of fraud, in protecting consumers' sensitive personal information, and in assisting victims of fraud."

But Givens said that this progress has come at a great price: "FACTA preempts the states, thereby preventing state legislatures from enacting laws in those areas covered by FACTA. Ironically, many of the consumer protection provisions in FACTA came from the states."

Preemption keeps states "from being the creative force in enacting additional consumer protections," Givens added.

The FTC estimates that 9.9 million people lost money because of identity theft in 2002 alone. In giving consumers the right to check their credit reports from all the major national credit bureaus (Equifax, Experian and TransUnion), lawmakers hope to encourage people to monitor their credit records for fraud and to act fast to control damage.

Free reports will be phased in starting with the Western states in December 2004; Midwestern states by March 1, 2005; Southeastern states by June 1, 2005, and Northeastern states by Sept. 1, 2005. (You can get free copies of your credit report now if you live in Colorado, Georgia, Maine, Maryland, Massachusetts, New Jersey or Vermont.)

On the same schedule, you can get free copies of any information about you on file with "specialty consumer reporting bureaus," including:

- Medical history reports from the Medical Information Bureau (www.mib.com).

- Property insurance reports, including CLUE reports (www.choicetrust.com).

- Bank account verification reports from ChexSystems (www.chexsystems.com).

Anti-fraud provisions

As of December, 2004, consumers who request a copy of their credit reports can ask that only the first 5 digits of their Social Security numbers be listed in order to protect the complete number from prying eyes.

FACTA also gives victims of identity theft the right to get free credit reports and to place free 90-day "fraud alerts" on their reports in order to inform potential creditors about the identity theft. (Victims can extend the alerts for seven years.) Victims of fraud also have the right to block fraudulent accounts from credit reports for free.

Military personnel on active duty now have the right to place a special alert on their credit files when they are out of the country. Creditors must contact active duty applicants when new credit applications are received. Active duty alerts remain on file for a year or until they are removed or renewed.

Sales and credit card receipts sometimes contain account numbers and expiration dates that can be used by unauthorized individuals. Under FACTA, companies must print partial numbers on receipts in a requirement that will be phased in through 2008. The law won't apply to handwritten receipts or those imprinted from the credit card.

Since June, victims of ID theft have had the right to obtain applications and transaction records from businesses where imposters fraudulently obtained credit, goods or services. The business must release copies upon written request to victims and federal, state or local law enforcement agencies. Businesses are allowed to require a police report or affidavit of fraud before releasing this material. The FTC offers a free PDF fraud affidavit form on its web site (www.ftc.gov).

Businesses will be liable for legal action if they block complete and reasonable requests.

Victims of credit fraud now have a measure of protection from bill collectors. After bill collectors have been notified that a debt is fraudulent, they are barred from further collection efforts and from selling the debt to other collectors.

ID thieves often search garbage cans to find bank records or loan applications that contain key credit details. The new law requires companies to shred or otherwise destroy records containing sensitive personal information.

Fraud alerts

Victims of ID theft who report the crime to credit reporting bureaus must be given special notice about their rights to initiate fraud alerts, block information resulting from fraud and obtain fraudulent credit applications and other key documents used in the crime. Proposed regulations and sample ID theft rights' notices can be found on the FTC web site.

For a fee, consumers who ask must be given details about how their credit score was determined. According to the law, a credit score is "a numerical value or categorization derived from a statistical tool or modeling system used by a person who makes or arranges a loan to predict the likelihood of certain credit behaviors, including default " The amount that consumers must pay for this information has yet to be determined.

Many credit reports contain serious errors and now consumers have new rights in disputing inaccurate information. Instead of dealing only with the credit reporting bureaus in correcting mistakes, you can go directly to the company that provided the inaccurate information. Once notified, the company cannot report inaccurate information to consumer reporting agencies.

Credit warning

Beginning in December, you must be given a one-time notice if a company you do business with is going to report a late or missed payment to a credit reporting agency. The notice can be on your statement or on a separate page. Notices must be sent within 30 days of the first such occurrence on each account. The Federal Reserve Board suggests this wording for the notice: "We have told a credit bureau about a late payment, missed payment or other default on your account. This information may be reflected in your credit report."

Employee misconduct

Employers are allowed to investigate employee misconduct without the worker's permission only if the employer is contracting with a third-party investigation firm.

Such investigations are allowed only if employees are suspected of misconduct, violations of law or written employer policies or failure to comply with government or industry regulations. (Employers conducting standard employment background checks must notify the employee.)

Employers who take action against employees based on information in a misconduct investigation must give the employee an "adverse action" notice and a summary of the investigation. The Privacy Rights Clearinghouse recommends that employees who receive such a notice contact an attorney, since these provisions give employees no rights to dispute the findings.

Medical information

The law attempts to prevent medical information from being revealed by consumer reporting agencies with a requirement to suppress names (such as "Cancer Center") or billing codes that might identify medical conditions. In most cases, companies are banned from using medical information to make credit decisions.

Consumer consent is required to disclose medical information for employment, credit or insurance purposes and any medical information requested for employment or credit purposes must be relevant.

Still to come

The following FACTA provisions are pending until final regulations are issued by the appropriate agencies:

- You will be able to stop companies from sharing information about you with their affiliates for marketing purposes. (You already have rights to limit information shared with third-party non-affiliates.)

- If you apply for a loan and are approved at a higher than normal interest rate, you must be told that you were granted credit on less favorable terms than other applicants. You will be entitled to a free copy of your credit report if this happens.

- Federal banking regulators must establish guidelines to "red flag" possible fraudulent transactions.

The Fair Credit Reporting Act, including FACTA amendments, can be found on the FTC web site (www.ftc.gov). The Privacy Rights Clearinghouse has a new fact sheet on FACTA provisions online at www.privacyrights.org. Other organizations working to keep consumers up-to-date on the new law and attendant regulations are U.S. PIRG (www.pirg.org) and the National Consumer Law Center (www.nclc.org).

Settlement means millions for consumer advocacy

Consumer Action is one of 16 non-profit organizations around the country that is sharing $5.9 million from a class action lawsuit and will use the funds to educate and counsel low income and minority consumers about financial services.

Consumer Action received $475,000. (See a full list of grants.)

The money comes from the settlement of a lawsuit against Providian Bancorp., a large credit card issuer that was charged with deceptive sales practices. Under the settlement, Providian paid $100 million in restitution and credits to affected customers.

When it was deemed impossible to distribute all the money to Providian customers, the court ordered a cy pres remedy, meaning it thought that the best possible use of the remaining funds was to make grants to community agencies that serve consumers through advocacy, education, counseling and other services.

CA Executive Director Ken McEldowney noted that cy pres funds are a unique and valuable way to support nonprofit educational and advocacy work. "Cy pres funding is just one of many ways in which the trial attorney community promotes consumer protection and education."

|

'The class action brought a measure of justice for many income-strapped families.' — Willard P. Ogburn |

McEldowney said that Consumer Action will use its cy pres funds over the next three years to help support its consumer complaint hotline, credit card surveys and a new office in Washington, D.C. staffed by Linda Sherry, the organization's editorial director.

Willard P. Ogburn is executive director of the Boston-based National Consumer Law Center, which received $700,000 from the fund. "For 35 years, the National Consumer Law Center has been protecting vulnerable consumers, often the kind of consumer that Providian took advantage of," said Ogburn. "The class action against Providian brought a measure of justice for many income-strapped families and improved business practices for the future."

Ogburn noted, "Unfortunately, despite all the efforts made to find all of the harmed consumers, some money was left over. Rather than seeing ill-gotten gains returned to the wrongdoer, the next best solution is to ask highly effective organizations like Consumer Action and the National Consumer Law Center to do more to help similarly vulnerable consumers."

Another recipient organization is the Center for Responsible Lending (CRL), a unit of the Center for Community Self-Help in Durham, NC. Mark Pearce, CRL executive vice president, commented that "cy pres awards are a tremendous help for policy and research organizations such as CRL that are focused on financial practices."

Pearce said that "significant resources are required to effectively identify and tackle abusive practices in an industry as complex as financial services. Cy pres funds are flexible so we can jump on opportunities to investigate practices that cause billions of dollars of harm to borrowers."

Caryn Becker, Esq. of the San Francisco-based law firm of Lieff, Cabraser, Heimann & Bernstein, LLP, said, "Our firm is thrilled to have the opportunity to direct cy pres funds to Consumer Action and the other organizations, where we know the funds will be used for groundbreaking and important work to advance the rights of consumers, consistent with the objectives of our Providian litigation. We hope this award will encourage other law firms with cy pres funds to consider Consumer Action and these other recipients in the future."

Cy pres awards generally carry few legal restrictions on their use. Unlike most charitable donations, cy pres funding often comes with no limits on lobbying, so that the money can be put to unrestricted use for advocacy and court actions.

Cy pres grantees often use the funds to monitor the marketplace for abuses that are similar in nature to those under litigation, to publicize deceptive practices and to educate consumers so they don't become victims.

In addition to Lieff Cabraser, the class was represented by Green and Jigarjian and The Sturdevant Law Firm, both of San Francisco; Kaplan, Fox and Kilsheimer of New York City, and Fine, Kaplan and Black of Philadelphia.

16 advocacy groups funded

The following organizations received funds from the Providian class action settlement cy pres fund:

- Center for Responsible Lending, Durham, NC, $350,000

- Community Legal Services, Philadelphia, PA, $600,000

- Consumer Action, San Francisco, CA, $475,000

- Consumers Union, Washington, DC, $150,000

- East Bay Community Law Center, Berkeley, CA, $400,000

- Equal Justice Works, Washington, DC, $250,000

- The Fair Business Practices and Investor Advocacy Chair, University of California Davis Law School, Davis, CA, $50,000

- Lawyers' Committee for Civil Rights of the San Francisco Bay Area, $600,000

- The Legal Aid Society, Employment Law Center, San Francisco, CA, $400,000

- Los Angeles Center for Law and Justice, Consumer Fraud Center, Los Angeles, CA, $150,000

- National Consumer Law Center, Boston, MA, $700,000

- People's Community Partnership Federal Credit Union, Oakland, CA, $100,000

- Public Citizen, Washington, DC, $700,000

- Santa Clara University Community Law Center, East Palo Alto, CA, $200,000

- Volunteer Legal Services Program, BASF Project, San Francisco, CA, $575,000

- Women's Way, Philadelphia, PA, $100,000

Call for full disclosure of 'bounce loan' costs

Banks provide bounce loans as a way for customers to write checks when they are running short of funds in their checking accounts, so that they can avoid having checks bounce and returned to them unpaid.

However, unlike a traditional overdraft protection plan, the fees on bounce loans are extremely high, and the loans must be repaid quickly. Many checking customers don't even know that their accounts carry this provision or that it can trigger large charges and a loan that must be repaid in a short time.

A coalition of consumer groups seeking stronger regulations to protect people from bounce loans is critical of proposed federal rules because they do not require advance notice to bank customers.

"The Federal Reserve has failed to protect consumers from bank 'bounce loans' that force consumers to pay triple-digit interest rates," said Jean Ann Fox, director of consumer protection at the Consumer Federation of America (CFA). "Bank bounce loans are payday loans without a contract or cost disclosure."

In comments filed with the Federal Reserve in August, CFA, the National Consumer Law Center, Consumers Union, the National Association of Consumer Advocates and the Chicago-based Woodstock Institute charged that the draft regulations allow banks to entice consumers to overdraw their accounts without a firm commitment to cover overdrafts and without clearly disclosing the cost of these loans. All other lenders are required to fully disclose charges under the federal Truth-in-Lending Act.

"Payday lenders, pawnshops, and finance companies have to comply with Truth-in-Lending law," said Gail Hillebrand, senior attorney for Consumers Union. "We think banks should too."

A growing number of banks and financial institutions have adopted bounce loan software and marketing programs. Advocates charge that only banks benefit from these programs because they boost overdraft fee profits.

A CFA survey of 50 financial institution web sites found 41 that advertise bounce loans, with more than a third actually encouraging consumers to overdraw their accounts. CFA found that banks charge fees of $20 to $35 for each overdraft as well as a fee of $2 to $5 per day until a deposit is made to cover the overdraft and fees. A $100 overdraft with a $20 fee carries an annual percentage rate (APR) of 520% if the overdraft is not repaid for two weeks.

"Bounce protection comes at too high a price," said Linda Sherry of Consumer Action. "Ask about it when you open a new bank account and if it comes with the account, consider having it removed."Sherry reported that some banks have resisted account holders' requests to remove the service. "You may have to be firm with the bank that you don't want it. Stress that you will move your account to another bank unless it is removed."

"If you'd like to protect yourself from bounced checks, sign up for a traditional overdraft protection line of credit or link your savings account to your checking account to cover overdrafts," she suggested. "While both services come with small fees, you'll be spared the overdraft fee of $20 to $35 for each bounced check."

For more information on traditional overdraft protection, see the Summer 2003 issue of Consumer Action News. It can be found online at [url=http://www.consumer-action.org]http://www.consumer-action.org[/url] or by sending a self-addressed, stamped envelope to Consumer Action-Overdraft Survey, 717 Market St., Suite 310, San Francisco, CA 94103.

Watch out for realistic but bogus cashiers' checks

Fake check scams are now the sixth most common Internet fraud, according to the National Consumers League (NCL). The scam has several variations, many of which start with an e-mail contact in which a stranger proposes to send you a cashier's check (often drawn on a foreign bank) that you can cash, keep some percentage of for yourself and wire the rest back to the sender.

If you fall for the scam, you'll more than likely find that the check is no good and you can't retrieve the money you wired. Even worse, you'll be fully responsible for your losses and you might even fall under bank scrutiny for wrongdoing.

Susan Grant, director of NCL's National Fraud Information Center (www.fraud.org) said, "Consumers are losing an average of $5,000 each in this clever scam where the con artists actually steal the money from banks but leave consumers holding the bag."

Grant said that people have become victims when they responded to "work at home" offers or notices about sweepstakes prizes. Scammers have also contacted individuals who advertise cars, jewelry or other expensive objects for sale.

Online auctions

In a similar scam growing more common with the popularity of online auctions, a buyer will bid high on an expensive item like a motorcycle or car, and send the seller a fake cashier's check for more than the item's value. The buyer will say that he or she sent extra money for shipping overseas and that a shipping company representative will pick up the merchandise. The buyer will ask the seller to give the merchandise and extra cash to the "shipper."

Even sellers who prudently wait for the check to clear can fall for this scam. Federal law requires that banks make the funds from deposited cashiers' checks available to account holders immediately, often before the checks have cleared.

Many of the checks are excellent forgeries that have fooled bank tellers.When the bank later learns that the check is no good, it will seek the funds from the person who deposited the check.

And when the checks bounce, the sellers are out not only for the merchandise, but also for any cash they gave to the so-called shippers.

Perpetrators of check scams frequently claim that they live abroad and don't have a convenient way to make payments, so they've asked someone in the U.S. who owes them money to send a check.

In some cases, victims are told they have won a prize and are asked to wire some of the money back as fees for collecting their winnings.

Protect yourself from cashier's check fraud

- Be cautious about accepting a cashier's check or money order drawn on a foreign bank, as it is more difficult to verify.

- Don't wire money to anyone you don't know or trust.

- Just because your bank allows you to withdraw funds from a cashier's check doesn't mean the check is good.

- If a stranger wants to pay you for something, insist on cash, a U.S. Postal Service money order or a U.S. cashier's check drawn on a local bank branch where you can verify that the funds actually exist.

- Be suspicious if someone offers to send you money for nothing, or more money than you are actually owed if they are purchasing something from you.

- Inspect all cashiers' checks carefully and call or visit the banks they're drawn on to verify them. Look up the bank online or in the phone book because contact information printed on the check might be bogus.

MoneyWi$e news

The MoneyWi$e financial education partnership between Consumer Action and Capital One, the Virginia-based credit card issuer, is now in its third year. Some of the project's recent accomplishments include:

- A new educational web site (www.money-wise.org), where all the MoneyWi$e materials can be found.

- "Saving to Build Wealth," the seventh MoneyWi$e educational topic, which includes a brochure, a lesson plan for train-the-trainer and classroom use, PowerPoint slides and a Leader's Guide.

- MoneyWi$e Best Practices Online, a newsletter with financial teaching tips, debuted this summer.