Released: June 01, 2023

Consumer Action INSIDER - June 2023

- What people are saying

- Panel digs into how inflation hits Hispanic households’ finances differently

- Consumer Action’s Linda Sherry receives CFA Consumer Champion Award

- Coalition Efforts

- CFPB Watch: Small medical debts gone; defending the CFPB; and refunds for fake debt relief

- Class Action Database: Unjustified fees result in BofA and Intuit settlements

- About Consumer Action

What people are saying

"I especially like the way Consumer Action keeps me up to date on the latest scams. Then I can warn clients, friends, and family."

—SCAM GRAM reader Marisol Ferrante, San Francisco, CA (subscribe to our mailing list to get the SCAM GRAM delivered directly to your inbox)

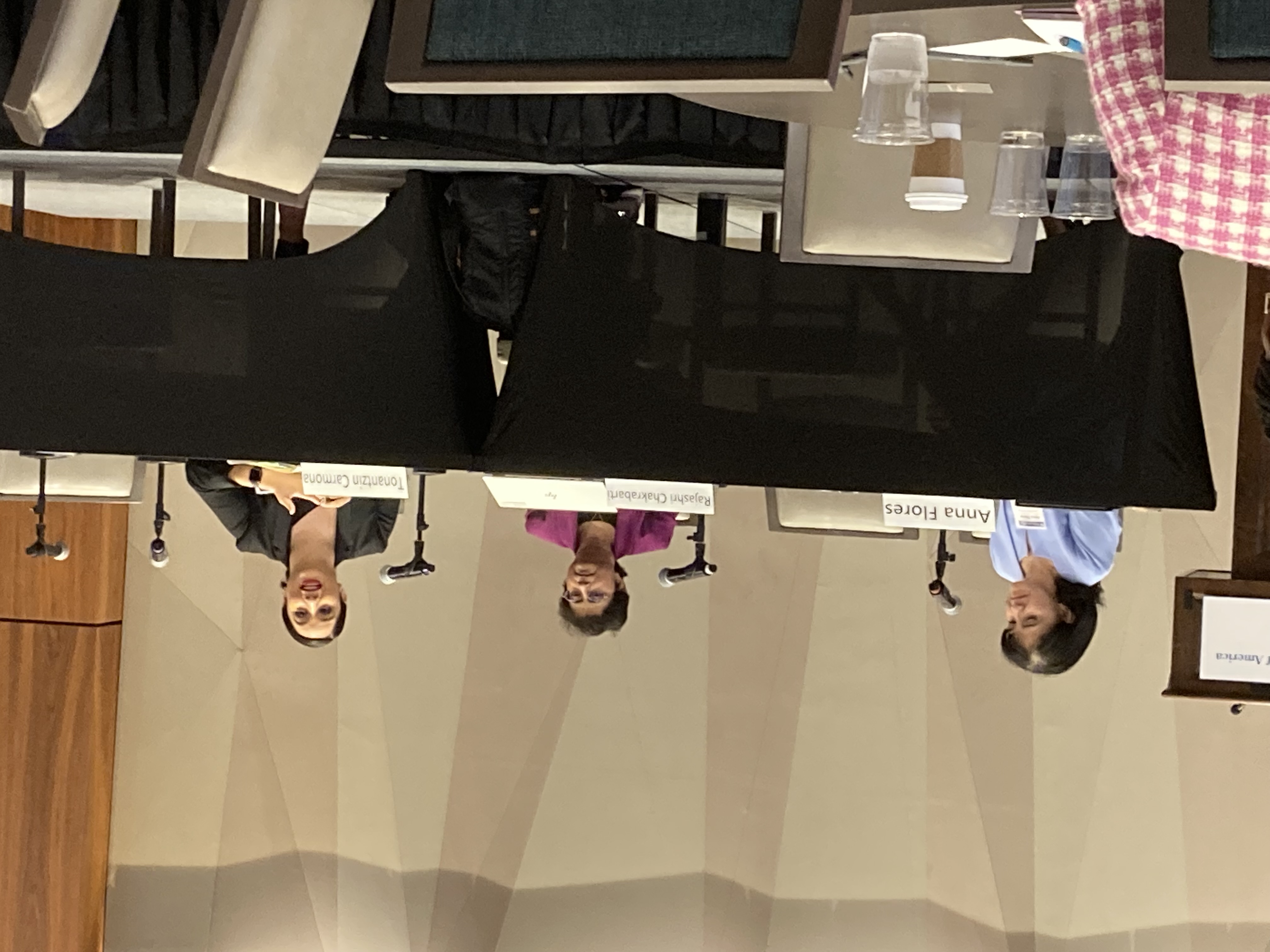

Panel digs into how inflation hits Hispanic households’ finances differently

By Ruth Susswein

At this year’s Consumer Federation of America (CFA) Consumer Assembly, one of the panels addressed how inflation has affected some Latino households differently than other communities. Anna Flores, Consumer Action’s interim executive director, moderated the panel on “The Disparate Experiences of Hispanic Households During the Recent Inflationary Period.” The panelists were Tonantzin Carmona, a David M. Rubenstein Fellow at Brookings Metro, and Dr. Rajashri Chakrabarti, head of Equitable Growth Studies at the Federal Reserve Bank of New York.

From the outset, the panel acknowledged that Latino/Latinx/Hispanic communities are a very diverse group, but noted that the research does not break groups up into distinct populations.

From the outset, the panel acknowledged that Latino/Latinx/Hispanic communities are a very diverse group, but noted that the research does not break groups up into distinct populations.

Dr. Chakrabarti studied the consumption patterns of these diverse groups and discovered that Hispanics have been more affected by inflation than other groups. She said that Latinos consume more transportation—more fuel and more used cars, which were key areas of price hikes during the recent inflationary period. While she did not specify, we might theorize that Hispanics may live farther away from their jobs, requiring many to use more fuel. Fortunately, when inflation pressure dropped somewhat, prices followed. Dr. Chakrabarti concluded that the inflationary pressure on Latinos is now “essentially no different” than any other group.

She also noted that earnings increased significantly for Blacks and Hispanics during this inflationary period. However, research showed that while “real earnings” grew in 2022, the gains were wiped out by inflation. In February through April of this year, there’s been a decline in earnings, and “real spending” has been flat.

Carmona explained that whether Latinx consumers are documented or undocumented has a great effect on their finances. Latinx consumers with limited access to traditional financial products and services often fall victim to alternative providers, such as payday lenders and check cashers with predatory terms, such as high interest rates and steep fees. More recently, the growing presence of crypto kiosks in these neighborhoods gives vulnerable consumers the false impression that these investments are a safe alternative to banks, when, in fact, these investments are not backed by any government agency, such as the FDIC. It’s imperative that we educate Hispanic consumers on the risks associated with unregulated alternative financial services and do more to ensure that these consumers have access to safe products.

Consumer Action’s Linda Sherry receives CFA Consumer Champion Award

By Anna Flores

Consumer Action’s former director of national priorities, Linda Sherry, received the Consumer Federation of America’s Consumer Champion Award at the organization’s 51st annual awards celebration, held on May 17 in Washington, D.C. Sherry was recognized for her more than 28 years of advocating on behalf of consumers—work that has had a profound and lasting impact on national public policy, consumer protection, and the consumer community at large. During her decades with Consumer Action, she was instrumental in transitioning us from a state education and advocacy group to a national one, which grew over time in size and impact, adding several advocates to represent underserved consumers before Congress, and educating consumers on myriad topics, from the rights of credit card holders to protecting your privacy online to avoiding the latest scams.

Sherry skillfully determined Consumer Action’s advocacy positions, providing formal and informal recommendations to legislative and regulatory policymakers and corporations, and co-wrote and edited a multitude of educational publications and newsletters. Over the years, she forged dozens of productive partnerships with companies and nonprofits, enabling Consumer Action to reach even more consumers and to amplify their voice. She provided effective leadership on a wide array of critically important issues throughout her career and served as the backbone of Consumer Action, managing whatever task was needed to forward the organization’s mission.

Sherry skillfully determined Consumer Action’s advocacy positions, providing formal and informal recommendations to legislative and regulatory policymakers and corporations, and co-wrote and edited a multitude of educational publications and newsletters. Over the years, she forged dozens of productive partnerships with companies and nonprofits, enabling Consumer Action to reach even more consumers and to amplify their voice. She provided effective leadership on a wide array of critically important issues throughout her career and served as the backbone of Consumer Action, managing whatever task was needed to forward the organization’s mission.

We congratulate Sherry on this honor, and will salute her ourselves with a Special Recognition Award at our 52nd anniversary reception, in November, in Washington, D.C. We hope you will join us. Look for event details in a future issue of the INSIDER and on the Consumer Action website.

Coalition Efforts

By Monica Steinisch

Consumer Action and its allies recently called on policymakers and regulators about these important issues:

Legislation that would lower drug prices. More than 40 advocacy groups, including Consumer Action, wrote to all members of the U.S. Senate, urging them to pass a package of bipartisan bills that, together, would close loopholes in the regulatory system and accelerate generic competition, resulting in lower drug prices for consumers. As the letter points out, 1 in 4 people in the United States has difficulty affording medications, with people of color disproportionately harmed by high drug prices. Read the letter here.

Privacy legislation that would protect teens, too. Consumer Action was one of nearly a hundred organizations to endorse the Children and Teens’ Online Privacy Protection Act (COPPA 2.0), bipartisan legislation reintroduced by Senator Edward Markey (D-MA) and Senator Bill Cassidy (R-LA) that would update online data privacy rules for the 21st century to ensure children and teenagers are protected online. According to the press release issued by Senator Markey’s office, the American Academy of Pediatrics has declared a national emergency for children’s mental health—a crisis fueled, in part, by Big Tech; particularly social media platforms. COPPA 2.0 updates the 1998 COPPA legislation, which instituted basic privacy protections aimed at protecting users under age 13, to extend existing privacy rules to teenagers aged 13 to 16. Read the letter here.

Capping credit card late fees at $8. Consumer Action and allies submitted comments in support of the Consumer Financial Protection Bureau’s (CFPB) Notice of Proposed Rulemaking on Credit Card Late Fees and Late Payments. Under the rule, which imposes an $8 cap on credit card late fees, consumers will save billions of dollars each year. The CFPB provided ample evidence that this amount is fair, reasonable, and proportional to the costs incurred by issuers for late payments. Significantly higher limits serve as a profit center for card issuers, which creates an incentive for issuers to engage in consumer-unfriendly practices to trigger the fee. Under the rule, issuers can charge more if they can justify the amount by demonstrating the true costs of dealing with late payments. The letter also conveyed the signers’ support of a 15-day courtesy period before a late payment fee could be assessed. Read the letter here.

Supreme Court’s decision on constitutionality of the CFPB. Consumer Action joined consumer advocacy allies in an amicus brief urging the Supreme Court to reject the Fifth Circuit’s decision, in the case CFSA v. CFPB, which declared the Consumer Financial Protection Bureau’s (CFPB) funding statute a violation of the Appropriation Clause of the U.S. Constitution. The decision was in direct contrast to an earlier ruling, by the Second Circuit, that the CFPB’s funding structure does not violate the Constitution. The CFPB is one of many federal financial regulators (Federal Reserve, FDIC, OCC, etc.) that are funded outside of Congressional appropriations. Congress chose to require independent funding for the CFPB when it created the Bureau in 2010 specifically so that the agency’s ability to function would not be threatened if lawmakers chose to defund the Bureau for political reasons. The case threatens to put the CFPB’s rules and casework regarding debt collectors, payday lenders, mortgage and student loan servicers, and other financial services entities at risk—efforts that have returned more than $16 billion to 190 million consumers. Read the press release about the amicus brief here.

CFPB Watch: Small medical debts gone; defending the CFPB; and refunds for fake debt relief

By Ruth Susswein

Nearly 1 in 5 American households has reported having some sort of overdue medical debt, which often lands on their credit reports. According to the Consumer Financial Protection Bureau (CFPB), medical debt is the most common collection item (57%) on credit reports.

Now, about half of those consumers with medical debt damaging their credit files will see the debts removed. All medical debts under $500 (reported from debt collectors) should be purged from credit reports as of April 2023. All paid medical debts should also be removed.

What’s more, the Big Three credit bureaus (Equifax, Experian and TransUnion) will not list overdue medical bills on a credit record until they are one year old. This gives consumers (and insurance companies) more time to pay or dispute medical bills.

Contact the three credit bureaus for a free copy of your credit report, and check that small medical debts, paid medical collection items, and medical debts less than a year old have been removed. If you find a debt that should have been removed, dispute it. Here’s how. If you continue to have a problem removing the debt, complain to the CFPB online or at 855-411-CFPB (2372).

Advocates stand up for the CFPB

For more than a dozen years, the Consumer Bureau has been the primary protector of consumers who’ve experienced unfair treatment or financial abuses in the marketplace, but there are some companies and some lawmakers that believe the CFPB is too powerful and “unaccountable.” They’re on a mission to dismantle the agency, and have targeted its funding structure. Agency opponents claim that even though Congress decided to fund the Bureau through the Federal Reserve (instead of through a pot of money directly from Congress), that it is “unconstitutional.” Payday lenders sued the CFPB on these grounds and convinced Trump-appointed judges in the Fifth Circuit Court of Appeals that they were right. The fight for the CFPB’s independent and reliable funding is headed to the Supreme Court this fall.

Consumer advocates and many others have come to the CFPB’s defense. Consumer Action has joined Public Citizen and other national consumer advocates in an amicus (friend of the court) brief arguing that the Bureau’s funding structure is no different than that of any of the other federal financial regulators, and that if the Supreme Court chooses to find fault with the CFPB’s funding model, it would call into question many federal agencies and many spending models that don’t strictly follow Congress’s direct appropriations model, including the Federal Reserve, the FDIC , the OCC, and others.

The CFPB has returned more than $16 billion to 192 million harmed consumers, has held predatory companies to account through lawsuits, and has issued rules that impact the mortgages, credit reports, credit cards and banking products consumers use. It conducts research and educates consumers on financial products, fights discrimination in housing and lending, and relies on consumers’ complaints to assist individuals and learn where patterns of abuse exist. We will continue to report on developments in this case.

Millions returned for bogus debt relief

More than 6,500 consumers who were misled by a Maryland debt relief company should have received a refund in the mail in May. Burlington Financial Group falsely promised consumers that it would reduce or rid them of credit card debt and improve their credit scores, according to the CFPB. The Bureau said that Burlington failed to produce any evidence that it had lowered or eliminated consumers’ debts. The CFPB is compensating harmed consumers through its victims relief fund.

If you did not receive a refund, submit a claim to cfpb-burlington.org. Send an email to .(JavaScript must be enabled to view this email address) or call 800-507-6157 with questions.

Class Action Database: Unjustified fees result in BofA and Intuit settlements

By Monica Steinisch

Among recent settlements added to the Consumer Action Class Action Database is the $6.5 million settlement in a case against major tuna fish producers Chicken of the Sea, Starkist and Bumble Bee alleging that the companies conspired to overcharge consumers for packages or cans of tuna 40 ounces or larger purchased from Wal-Mart, Costco, Sam’s Club, DOT Foods or Sysco between June 2011 and December 2016. Claim forms are due June 21.

The following two settlements are of interest for the allegations in, and the outcomes of, the cases, but do not appear in our Class Action Database because no action is needed to receive payment.

In the first case, Bank of America (BofA) agreed to an $8 million settlement to resolve allegations that the bank charged unfair overdraft and non-sufficient funds (NSF) fees on some transactions between May 19, 2017, and Feb. 16, 2023. The case addresses BofA’s practice of charging NSF or overdraft fees on checks processed for payment more than one time after having been initially returned for insufficient funds and assessed an NSF fee. In addition to agreeing to refunds for eligible customers, the bank has ceased the double-processing practice and committed to not re-establish the practice for at least five years. You do not need to file a claim to receive payment; funds will be distributed automatically to eligible BofA customers. Learn more here.

The second notable case is the $141 million that Intuit, maker of the widely used TurboTax tax preparation software, agreed to pay to settle allegations made by a coalition of state attorneys general that the company improperly charged filing fees to some consumers who, based on their income (AGI of $73,000 or less), were eligible to file their tax returns for free through the IRS’s Free File Program. If you’re one of the approximately 4.4 million U.S. consumers who paid Intuit to file your federal tax return for the 2016, 2017 and/or 2018 tax years, when you should have been allowed to file for free, you should be notified by email by the settlement fund administrator, and you will receive a payment automatically, without needing to file a claim. Learn more here.

About Consumer Action

Consumer Action is a nonprofit organization that has championed the rights of underrepresented consumers nationwide since 1971. Throughout its history, the organization has dedicated its resources to promoting financial and consumer literacy and advocating for consumer rights both in the media and before lawmakers to promote economic justice for all. With the resources and infrastructure to reach millions of consumers, Consumer Action is one of the most recognized, effective and trusted consumer organizations in the nation.

Consumer education. To empower consumers to assert their rights in the marketplace, Consumer Action provides a range of educational resources. The organization’s extensive library of free publications offers in-depth information on many topics related to personal money management, housing, insurance and privacy. At Consumer-Action.org, visitors have instant access to important consumer news, downloadable materials, an online “help desk,” the Take Action advocacy database, and more. Our in-language media outreach allows us to share scam alerts and other timely consumer news with a wide non-English-speaking audience.

Community outreach. With a special focus on serving low- and moderate-income and limited-English-speaking consumers, Consumer Action maintains strong ties to a national network of more than 6,500 community-based organizations. Outreach services include in-person and web-based training and dissemination of financial and consumer education materials in many languages, including English, Spanish, Chinese, Korean and Vietnamese. Consumer Action’s network is the largest and most diverse of its kind.

Advocacy. Consumer Action is deeply committed to ensuring that underrepresented consumers are represented in the national media and in front of lawmakers. The organization promotes pro-consumer policy, regulation and legislation by taking positions on dozens of bills at the state and national levels and submitting comments and testimony on a host of consumer protection issues. Additionally, its diverse staff provides the media with expert commentary on key consumer issues supported by solid data and victim testimony.